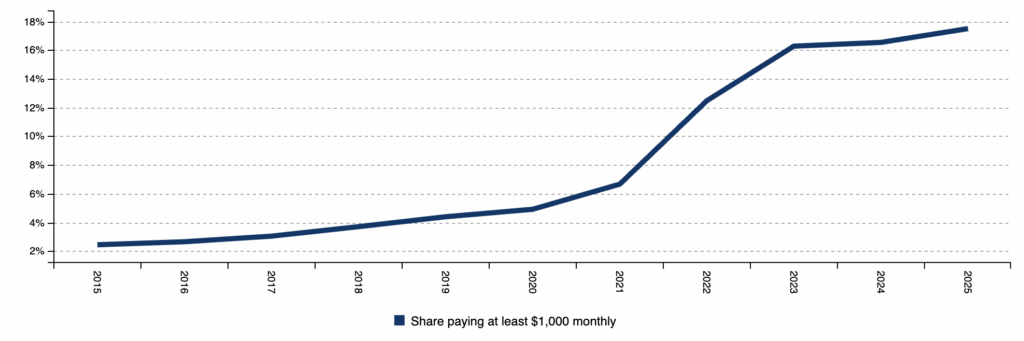

The proportion of Americans taking on towering car notes has swollen to levels that would have seemed improbable a decade ago. In 2015, scarcely more than two percent of new car buyers dared to shoulder a monthly payment above the thousand-dollar mark. Today, nearly one in six new-car customers is signing on for that obligation. Is it a car loan affordability crisis?

Such hefty commitments are the result of an industry struggling under the weight of high prices, interest charges, and ballooning loan amounts. Trucks and SUVs dominate the landscape: more than half of buyers making hefty monthly payments drive away in an SUV, while just under twenty percent select pickups. A small percentage of new car buyers have new car payments under $400, according to Philip Medeiros of Colonial Chevrolet.

Cody Anderson, the general sales manager at Freedom Ford in Greenville, Texas, told Automotive News he sees the contrast firsthand. For those who have researched current prices, the burden doesn’t come as a shock. But customers who last bought when prices were lower often reel at the new reality. “The reaction can be jarring,” Anderson notes, “because their frame of reference is still anchored five years in the past.” source: Ford/Automotive News

source: Experian

$1,000-plus payments in the past decade.

Automotive Industry Data (Most Relevant)

Edmunds – Multiple reports tracking $1,000+ monthly car payments:

- 2025 Data: Record 1 in 5 new-car shoppers (19.3%) committed to $1,000+ monthly payments in Q2 2025, Edmunds carscoops

- Trend Analysis: The share of borrowers with payments over $1,000 jumped to 17.5% in 2023, which was “four times as many as before the pandemic.” Invesopedia

- Historical Context: This represents the highest percentage since at least 2019

Experian Auto Data:

- 2024: More than 4% of drivers are making $1,000+ auto loan payments monthly, up from 3% in 2023, Experian

- State-specific: Texas leads with 6.9% of borrowing drivers paying $1,000+ monthly, according to Experian

Inventory shortages pushed the share of high-payment loans from under seven percent in 2021 to more than fifteen percent the following year. Even as supply recovered, affordability continued to lag. Experian’s data shows the figure rose again in 2023 and has hovered upward in 2024.

The typical new-vehicle loan this year reached nearly $42,000, carrying an interest rate close to seven percent—far steeper than the sub-four percent average in 2015. Loan terms have stretched too, from under 60 months to well beyond 68 months. finance .yahoo

Historical Comparison (2015 rates):

The Federal Reserve data shows rates were significantly lower in 2015 than today’s ~7% rates.

Primary Sources for Your Quote:

- Experian’s “State of the Automotive Finance Market” Q2 2025 – Most comprehensive data

- Bankrate Auto Loan Reports (September 2025) – Current market analysis

- Federal Reserve Economic Data (FRED) – Historical rate comparisons

Times have surely changed from when I was in business. What emerges is a portrait of buyers caught between aspiration and arithmetic.

The allure of bigger, better-equipped vehicles collides with economic gravity, leaving many households tethered to payments that rival a mortgage. Whether relief arrives in the form of rate cuts, lower prices, or softened demand remains an open question.

Buyers taking on these loans are not always prime borrowers either: average credit scores have slipped slightly, suggesting that more customers with middling credit are stretching themselves thin. Yet the draw of large, well-equipped vehicles endures, furthering the car loan affordability crisis.

INDUSTRY JARGON – BEING UPSIDE DOWN

In my past life in the automotive business, I worked in several managerial positions. As a finance manager, I saw firsthand how people struggled with basic math and understanding how auto loans work. They were thereby placing themselves in a financial burden—case in point: When you’re upside down.

Let’s pretend, for this example, you own a three-year-old SUV with high mileage, and you want to trade it for a new one.

When an auto dealer tells you that you’re “upside down” on your trade-in, it means you owe more money on your current car loan than the vehicle is actually worth. This situation is also called being “underwater” or having “negative equity” in your car. cnbc

This is extremely common – approximately 26.6% of trade-ins currently have negative equity, with the average amount being $6,754. edmunds

Why This Happens

Several factors contribute to being upside down on a car loan : chase

- Rapid depreciation: New cars can lose 20% of their value in the first year

- Long loan terms: Average loan terms are around 6 years, but people typically trade in after 4 years

- Low down payments: Without substantial money down, you’re immediately underwater

- High purchase prices: Cars bought during market peaks or with markups

Your Options

When you’re upside down, you have several choices : consumer. ftc

- Pay the difference in cash: You can pay the negative equity amount upfront to clear the debt

- Roll it into your new loan: The dealer adds the negative equity to your new car loan, increasing your monthly payments and total interest costs

- Wait it out: Continue making payments until you reach positive equity

- Use manufacturer incentives: Large rebates can sometimes offset negative equity

Important Warning

Be cautious of dealers who claim they’ll “pay off your loan no matter what you owe.” Often, they’re simply rolling that negative equity into your new loan, meaning you’ll pay more monthly and accumulate even more debt. Always review your financing documents carefully to understand exactly how they’re handling your negative equity before signing any contracts. consumer. ftc

This situation, while frustrating, is manageable with the right strategy based on your financial circumstances and timeline.

Anderson points out that many of his F-150 buyers purchase for personal enjoyment rather than strictly for utility, valuing comfort and technology when they know they’ll spend hours each day behind the wheel.

While the Federal Reserve’s recent quarter-point cut hints at easing, analysts caution it will scarcely dent the affordability crisis. Tariffs loom as an added threat, projected to bleed billions from the U.S. auto sector if enacted. For now, sales managers urge transparency. “If you don’t set expectations early,” Anderson warns, “sticker shock can derail the conversation altogether.”

Read how Consumer use of AI assistants and answer features is rising, especially for exploratory and comparison questions.

Mark Medeiros is a digital strategist and the founder of Slocum Studio, an agency focused on web design, development, and AI solutions. Leveraging a unique background as a former GM franchise owner, he provides actionable marketing and content consulting to drive growth for businesses, non-profits, and startups through Slocum Studio and Bizzheadsai.com.

Write for us

Blog post submission