What Defines Automobile Affordability?

Automobile affordability doesn’t simply refer to the upfront purchase cost. It involves a range of considerations that affect a vehicle’s total ownership cost, from fuel efficiency and maintenance to insurance and depreciation.

The post will help you put things into perspective. However, it would be best to research before going into an automobile dealership. Drill down on the vehicle or vehicles you are interested in. Most importantly, be informed.

I spent 35 years building my career in the automobile industry, starting as a service technician and working my way up to president of the company. Along the way, I gained an in-depth understanding of how the industry operates, and I’ve truly seen it all. From smart decisions to costly missteps, I’ve witnessed the full spectrum of what can go right—and wrong—when buying a car.

Mark Medeiros

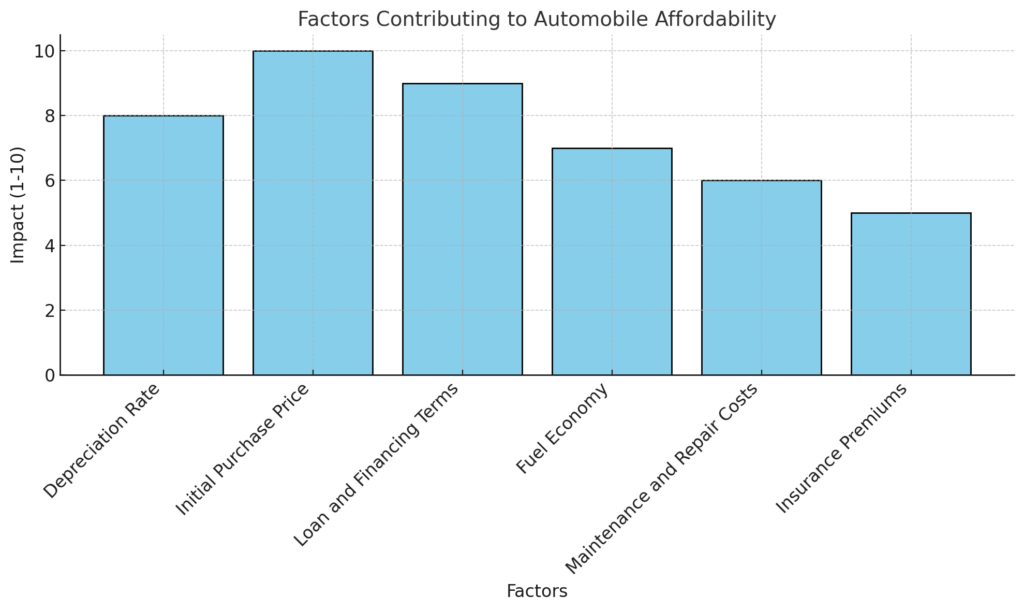

Factors that contribute to automobile affordability include:

Depreciation Rate: Cars that depreciate faster will be worth less in 3 years, usually half the time of a typical auto loan. That is to say, people may think their car is worth much more than it is.

Initial Purchase Price: The manufacturer’s retail price (MSRP) and upfront cost (money down) remain one of the most significant affordability aspects.

Loan and Financing Terms: Financing options and interest rates dramatically affect a buyer’s monthly payments and financial burden.

Fuel Economy: With fluctuating fuel prices, few buyers consider the cost of fuel and its long-term affordability. Large trucks and SUVs are not fuel-efficient vehicles, and those costs can add up.

Maintenance and Repair Costs: Some models have higher repair and upkeep costs, which can add to the total cost of ownership.

Insurance Premiums: Car models have varying insurance costs based on safety ratings, accident history, and theft statistics.

Morbi ut viverra massa mattis vitae blandit ut integer non vestibulum eros, diam in in et hac mauris maecenas sed sapien fermentum et eu.

Current Trends in Automobile Prices

The price of new and used cars has risen steadily in recent years, influenced by various market factors, such as union wages and health insurance. Understanding this is important for consumers seeking affordable options in a fluctuating market.

- Supply Chain Disruptions: The recent COVID pandemic affected manufacturing and shipping, creating vehicle shortages that drove up car prices globally. Dealers were in their heyday asking over the sticker and getting it.

- Increased Demand for Used Cars: Due to high prices for new vehicles, many consumers have turned to the used car market, driving demand and raising prices.

- Technological Advancements: As cars are equipped with more advanced safety, connectivity, and eco-friendly technologies, their production costs—and consequently prices—have increased.

- The cost of money: General inflation and interest rates impact borrowing costs, affecting how much consumers can finance their vehicle purchases.

The cost of ownership

For most buyers, financing plays a significant role in automobile affordability. Be sure to do your research:

- Bank Loans vs. Dealership Financing: Dealership financing may offer promotional rates utilizing manufacturing incentives. However, bank loans, especially credit union loans, sometimes provide more favorable terms over time. Consumers should compare these options to find the best rate.

- Interest Rates: Do the math; lowering interest rates reduces the overall loan cost, which can make a significant difference, especially on long-term loans.

- Loan Term: A longer loan term lowers monthly payments; it may increase total costs due to additional interest payments.

- Leasing: Leasing can be an affordable alternative for consumers who prefer driving a new car every few years. This benefits businesses and is an all-in-one expense using tax and finance.

- Mileage: Calculate the miles you plan to drive before leasing. Lease contracts charge up to .25 cents per mile for luxury cars over 10 or 12k miles annually.

- Credit Score: A strong credit score can lead to better financing rates, reducing monthly costs and making a vehicle more affordable.

The Affordability Challenge of Electric Vehicles

Electric vehicles (EVs) are popular due to their environmental benefits and the fact that they don’t need fuel. However, lately, sales have stalled, and manufacturers are concerned.

- Higher Initial Purchase Price: Although EVs typically have lower maintenance and fuel costs, the upfront price can be way out of reach unless your a high-income earner.

- Government Incentives: Many regions offer incentives for EV purchases, including tax credits and rebates that can offset the initial cost.

- Lower Running Costs: EVs eliminate the need for gasoline and have fewer moving parts, which may translate into lower maintenance costs over time. But the jury is still out.

- Battery Replacement Costs: EVs have fewer mechanical issues, but battery replacement can be expensive, affecting long-term affordability.

Making Your Automobile Purchase More Affordable

There are several strategies that can help consumers make a more affordable car purchase:

- Consider Certified Pre-Owned (CPO) Vehicles: CPO cars are usually newer used cars that have undergone rigorous inspections and come with extended warranties. They offer the benefits of a new car at a lower cost. When I was selling cars, especially Cadillacs, I found this to be a great option for buyers.

- Research Resale Value: Some cars hold their value better than others, which can be advantageous if you plan to sell or trade-in your vehicle in the future. Please don’t buy a car without researching its value down the road.

- Leverage Seasonal Discounts and Incentives: Car dealerships often provide discounts around certain times of the year, such as the end of the model year or during holiday sales events.

- Look for Low-Interest Financing Offers: Some manufacturers offer incentives like low interest rates on new vehicles, especially if the model isn’t a popular seller or vehicle inventory is backing up.

- Optimize Loan Terms: Shorter-term loans may have higher monthly payments but can save on interest, making the vehicle more affordable.

The Role of Technology in Determining Car Affordability

New technology is one of the major cost drivers in modern vehicles. Features such as autonomous driving capabilities, enhanced safety systems, infotainment systems, and eco-friendly engines add to a car’s value and increase its price.

However, these features may offer value in terms of fuel savings, insurance discounts, and resale value. For consumers factoring long-term affordability, a balance between basic features and high-tech add-ons is crucial.

How Insurance Affects Automobile Affordability

Insurance premiums are often overlooked, yet they can have a major impact on the total cost of owning a vehicle.

Factors that affect insurance costs include:

- Car Model and Safety Ratings: Safer cars with high crash ratings often have lower insurance premiums.

- Age and Driving History of the Owner: Younger drivers or those with a history of accidents may face higher premiums.

- Location: Urban areas with higher accident or theft rates typically have higher insurance premiums.

- Type of Coverage: Comprehensive coverage increases costs but provides more protection. Consumers should carefully evaluate the coverage they need.

Maintenance in Long-Term Affordability

Vehicle maintenance costs vary by model, age, and usage. Additionally, some brands are known for reliability. Research which vehicles require less servicing.

Once you own a vehicle, regular servicing can prevent expensive repairs, making it more affordable in the long run. Tips for reducing maintenance costs include:

- Routine Oil Changes and Tire Rotations: Simple, regular servicing and checkups can prolong a vehicle’s life.

- Choosing Reliable Brands: Research reliability ratings to find models with lower long-term maintenance needs.

- Warranty Coverage: Consider an extended warranty if the price is reasonable it may save you quite a bit of money down the road.

The Impact of Depreciation on Automobile Affordability

Depreciation is the difference between a car’s purchase price and resale value. Cars lose value over time, but the depreciation rate varies by model. If you’re concerned about affordability, choosing a car with slower depreciation can mean retaining more of its value.

Some ways to offset depreciation include:

- Choosing Models with High Resale Value: Research the best brands and models for resale value.

- Avoiding Unnecessary Modifications: Customizing a car can lower its resale value, so avoiding excessive modifications is best.

- Keeping Mileage Low: Lower mileage often translates to better resale value.

Final Thoughts on Automobile Affordability

By now, you know that automobile affordability requires an understanding of multiple cost factors, from upfront price to long-term maintenance and resale value.

You can make intelligent choices by researching options, comparing financing, and understanding the hidden costs that affect a vehicle’s affordability.

Remember to make the best choice considering the cost of the vehicle, the maintenance costs, and the resale value down the road. Get these right, and you will have made a good choice.

Whether you’re purchasing a new car, leasing, or considering an electric vehicle, a well-informed approach will help you find a vehicle that fits your budget both now and in the future.